South Florida Real Estate Market Review 2025 and 2026 Outlook: A Difficult Year That Redefined the Market The year 2025 was not an easy year for real estate. It unfolded under the weight of elevated interest rates, rising insurance and HOA costs, political[…]

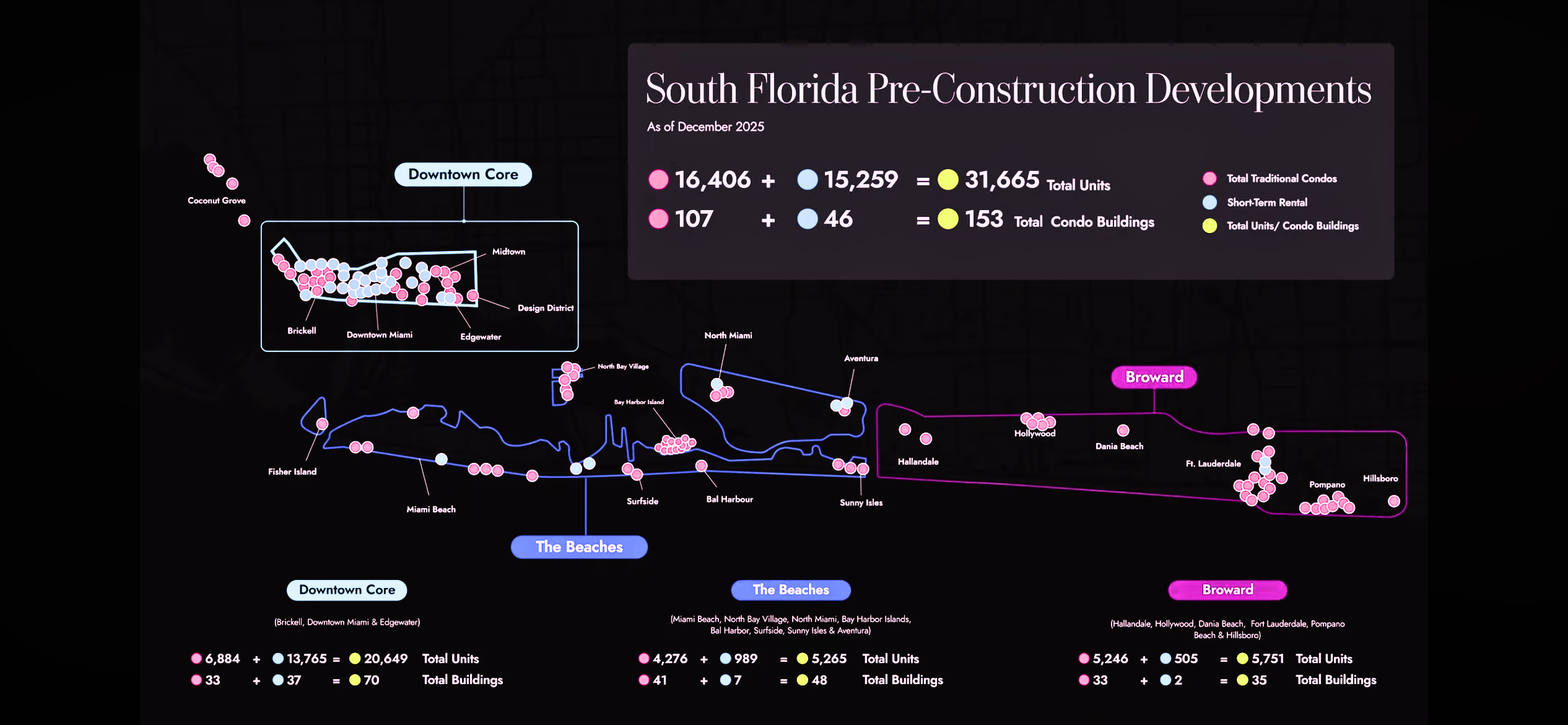

South Florida – 2025 Real Estate Review and 2026 Outlook