South Florida Real Estate Market Review 2025 and 2026 Outlook:

A Difficult Year That Redefined the Market

The year 2025 was not an easy year for real estate. It unfolded under the weight of elevated interest rates, rising insurance and HOA costs, political uncertainty, and renewed geopolitical tension following tariff announcements and escalation rhetoric on the global stage.

Yet paradoxically, it was precisely this challenging environment that confirmed South Florida’s transformation from a cyclical boom market into a structural, global real estate hub.

Rather than weakening uniformly, the market segmented—exposing fragile assets while reinforcing demand for quality, location, and scarcity.

Media Recognition: Miami as a True “Outlier” Market

Throughout 2025, a rare consensus emerged across national and international media:

-

Miami and South Florida ranked among the top global destinations for second homes

-

Florida became home to the most expensive ZIP codes in the United States, surpassing California

-

The luxury real estate segment continued to demonstrate exceptional resilience compared to national trends

This recognition marks a turning point. The market no longer needs defending—the data speaks for itself.

Ultra-Luxury Sales: Near-Historic Performance Under Pressure

Transactions Above $10 Million

Since 2020, sales above $10 million have served as a key indicator of structural demand. In 2025:

-

394 transactions above $10 million were recorded across South Florida (more than one ultra-luxury sale per day)

-

This performance came very close to the all-time record of 415 transactions in 2021, a year defined by 3% mortgage rates

The significance lies in the context: these results were achieved despite high borrowing costs and elevated macro uncertainty, underscoring the dominance of cash buyers and long-term capital.

Transactions Above $30 Million and $50 Million

At the very top of the market, concentration of wealth became even more apparent:

-

64 transactions above $30 million in 2025, nearly double the 2021 total

-

17 transactions above $50 million, primarily waterfront properties

These figures confirm a powerful trend: the ongoing migration of global wealth to South Florida is permanently raising the ceiling of the market.

Single-Family Homes: Severe Scarcity at the Top End

By the end of 2025, approximately 15,000 single-family homes were listed on the MLS across South Florida. However, segmentation reveals a stark imbalance:

Category A: High-quality luxury homes (≤15 years old, contemporary design, often waterfront)

-

Only 159 properties available

-

Average list price: approximately $36 million

Category B: Similar quality without waterfront

-

Approximately 2,300 properties

Category C: General market

-

Nearly 12,000 properties

-

Average pricing around $1 million

The scarcity of modern, high-quality inventory—combined with sustained international and domestic demand—continues to place upward pressure on pricing, even during periods of broader market stress.

The Condominium Market: A Structural Imbalance, Not an Oversupply

At first glance, condominium inventory levels appear balanced. In reality, the situation is far more nuanced:

-

Fewer than 7,600 condominiums under 30 years old are truly attractive to today’s buyers

-

Older buildings face mounting challenges, including:

-

Special assessments

-

New safety and reserve requirements

-

Deferred maintenance

-

Rising insurance and HOA costs

-

As a result, headline inventory figures are misleading. Much of the available stock is functionally obsolete in the eyes of modern end-users and international investors.

This structural imbalance explains the persistent strength in demand for new developments and recently built condominiums, even during a difficult macro year.

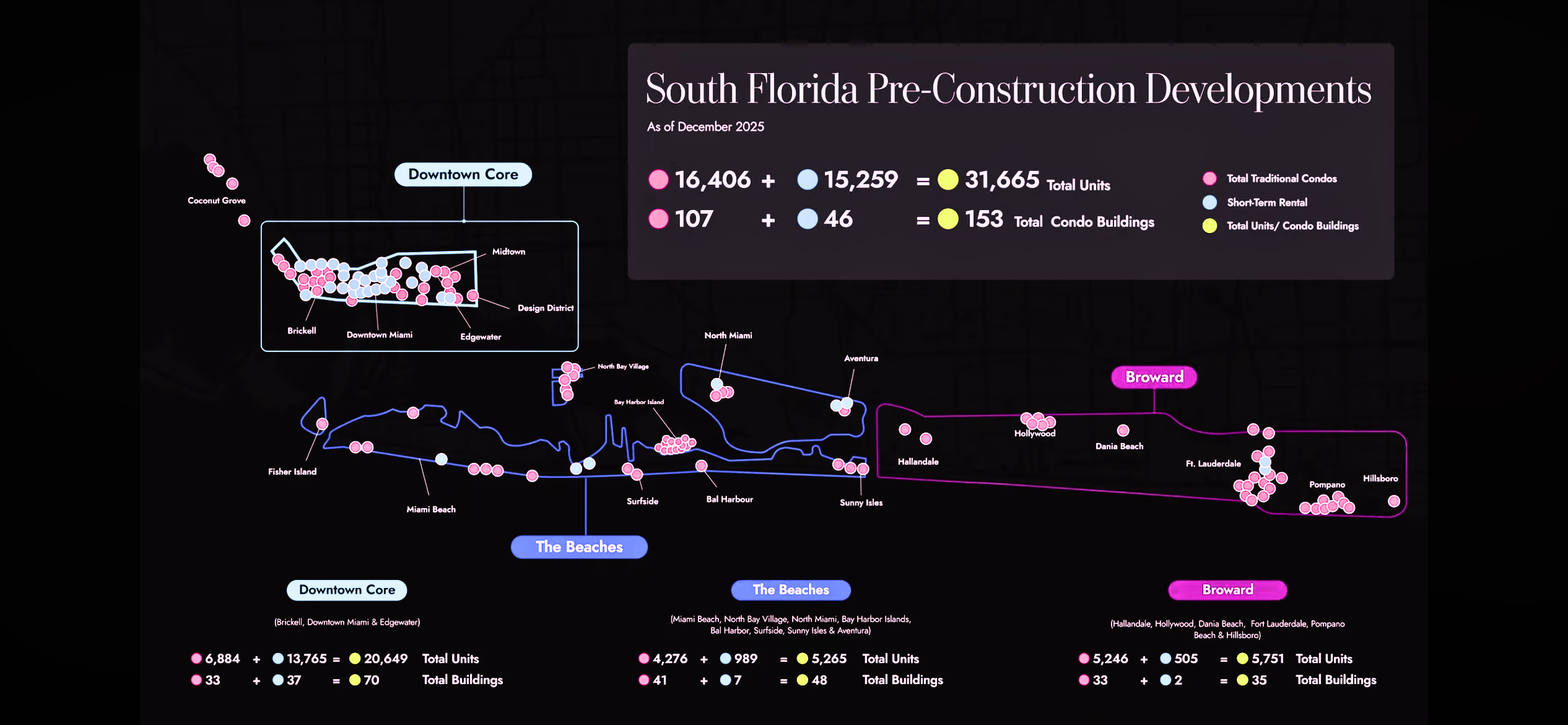

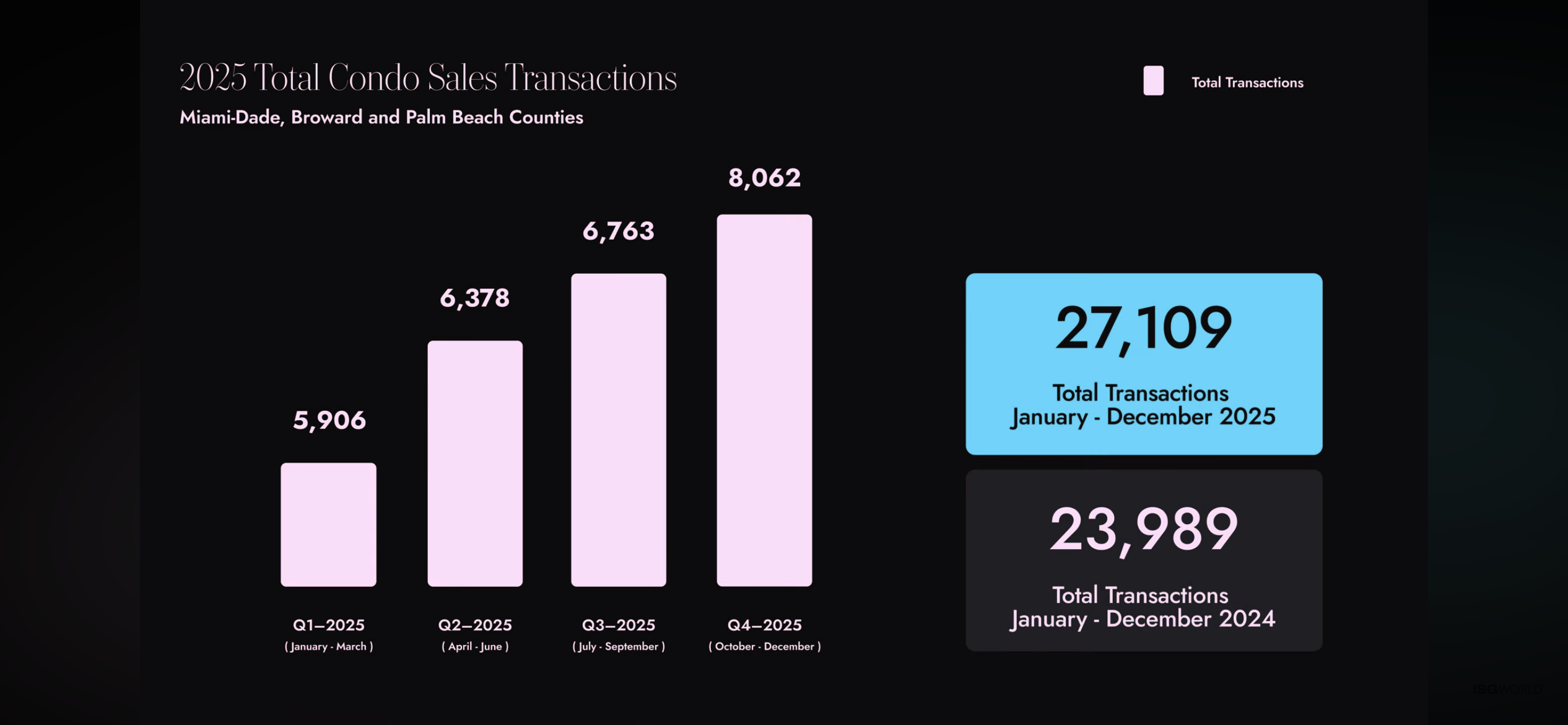

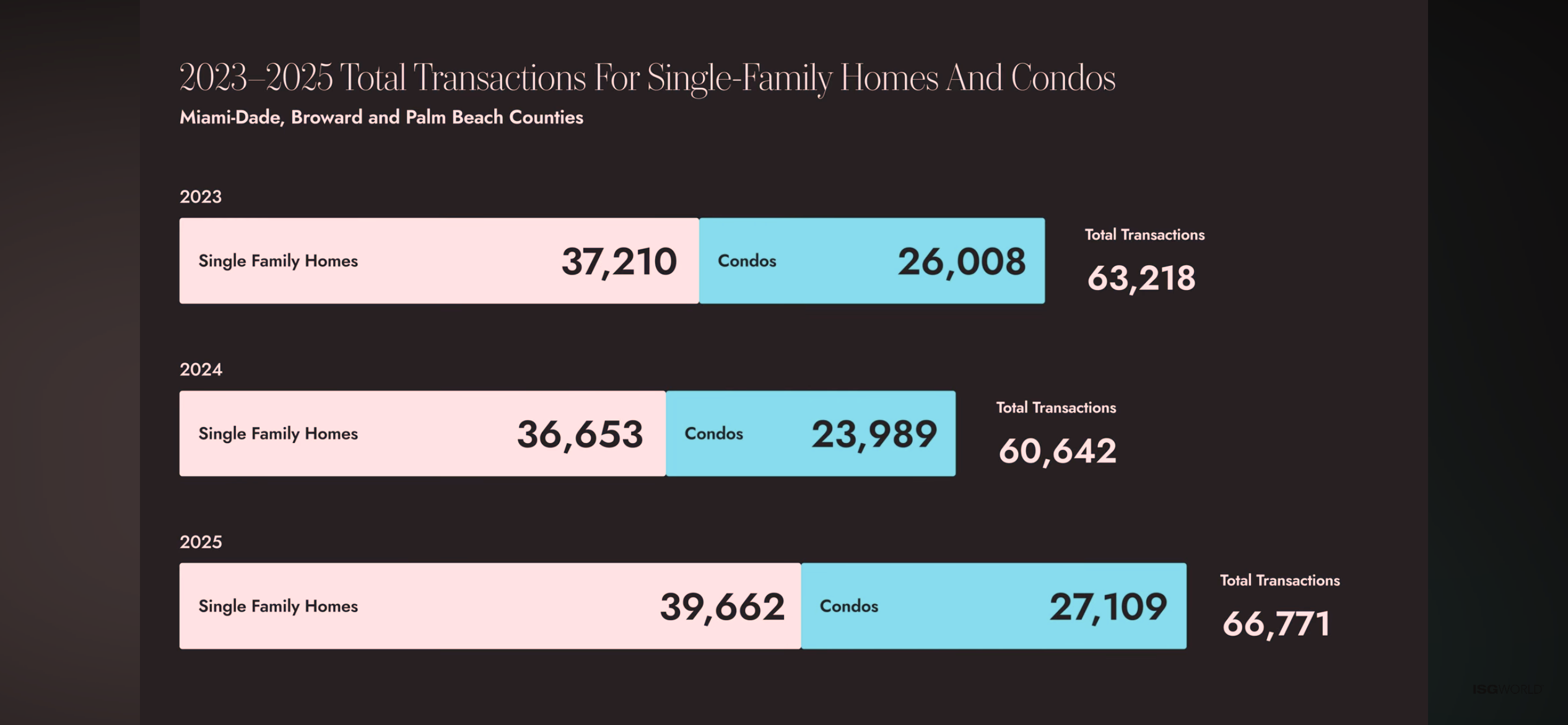

MLS Condo Sales Transactions 2025 (Miami Dade, Broward and Palm Beach Counties)

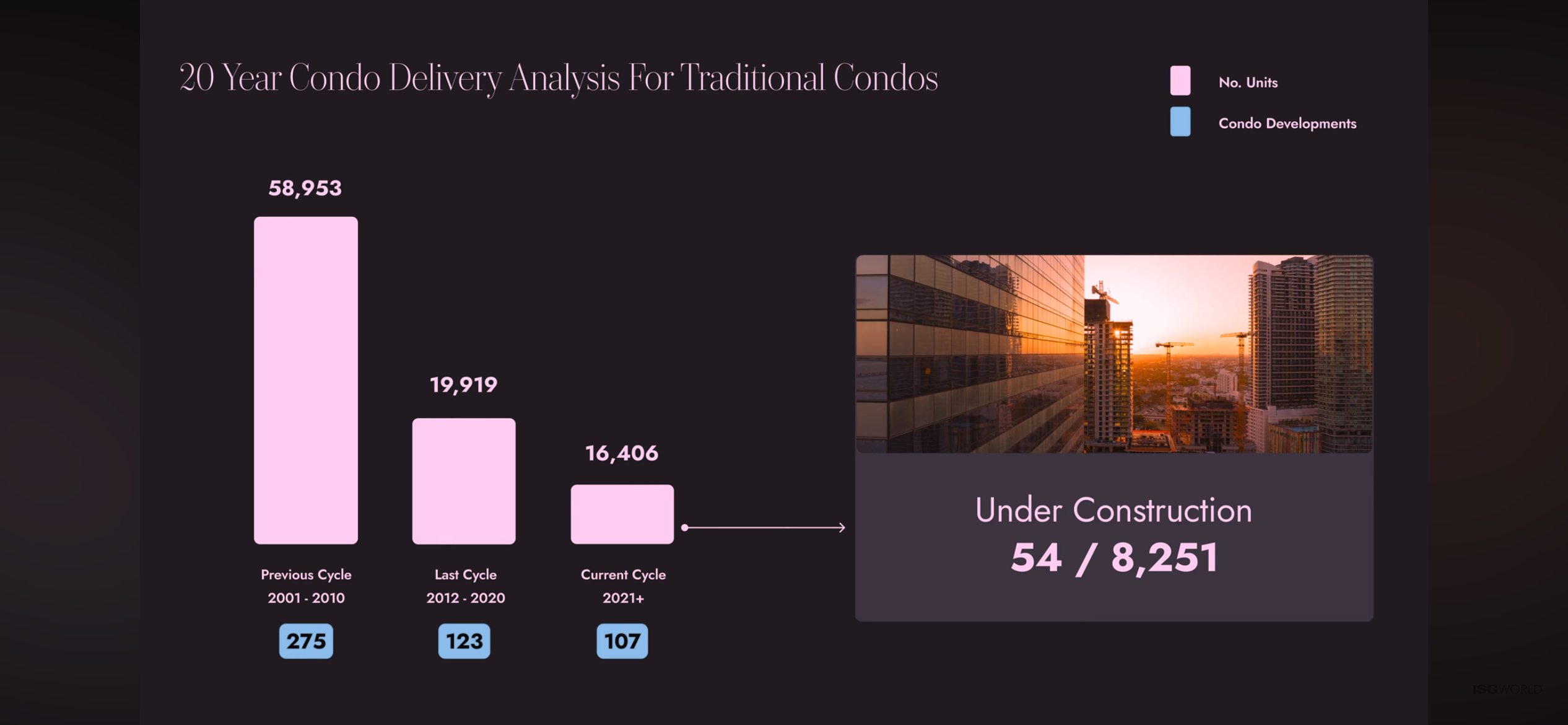

New Development vs. Demographic Reality

In 2025:

-

Approximately 153 condominium projects were under development across Miami-Dade and Broward counties

-

Roughly 16,400 traditional residential units were planned for primary residence use

However, it is essential to clarify that these projects will not be delivered at once.

Most of this supply is scheduled to be delivered progressively between 2026 and 2030—and in some cases beyond. Many projects are still in early or mid-construction phases, and today’s towers—often 50, 60, or even 100 stories tall—require significantly longer planning, financing, and construction timelines.

In practical terms, supply exists on paper, but becomes usable slowly and in phases.

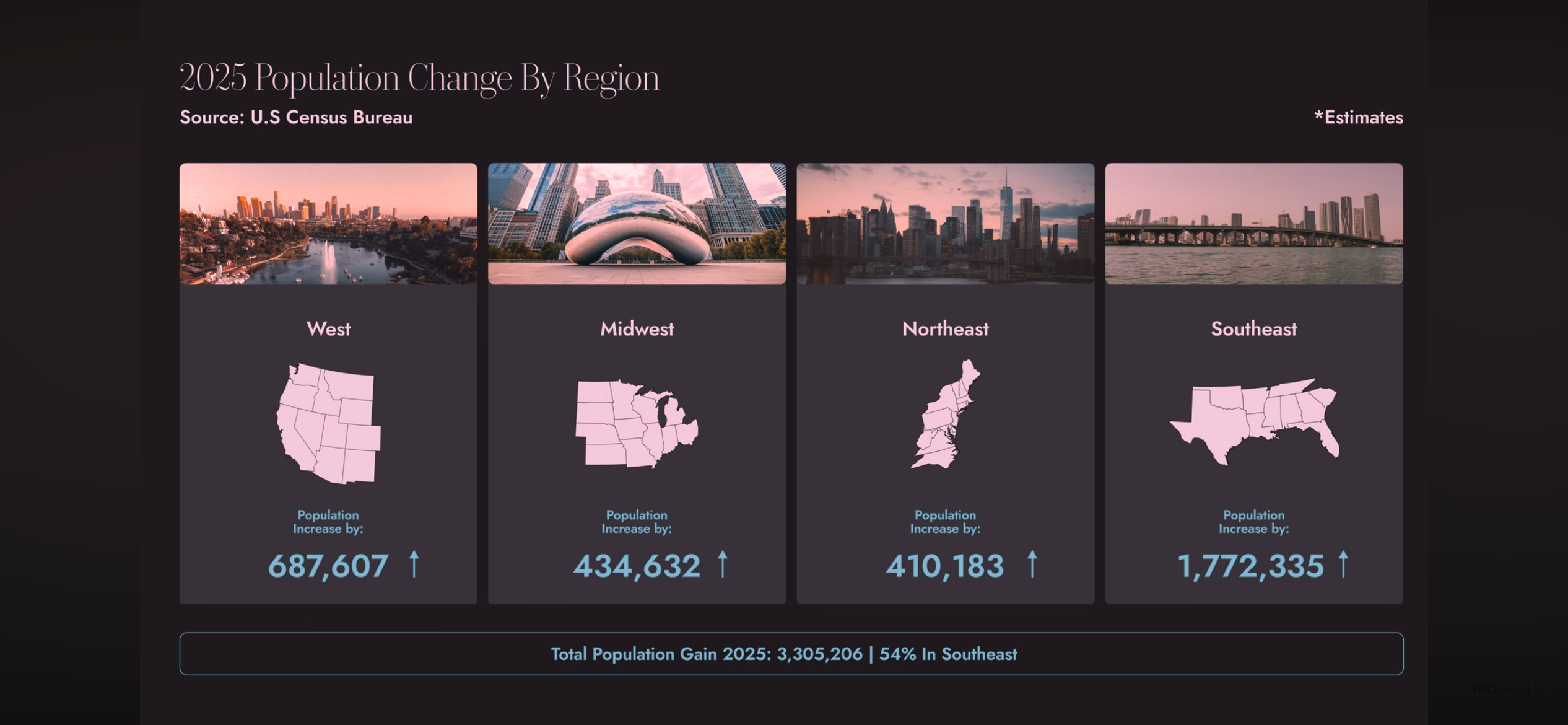

Record Population Growth Continues to Outpace Supply

Florida experienced record domestic net migration in 2025:

-

Approximately 1,350 new residents per day moved to Florida from other U.S. states

-

Roughly one-third settled in South Florida

-

Only Texas grew faster, with approximately 1,450 new residents per day

This level of sustained population growth creates continuous demand for:

-

Primary residences

-

Long-term rentals

-

New, code-compliant housing

Importantly, this is end-user demand, not speculative demand.

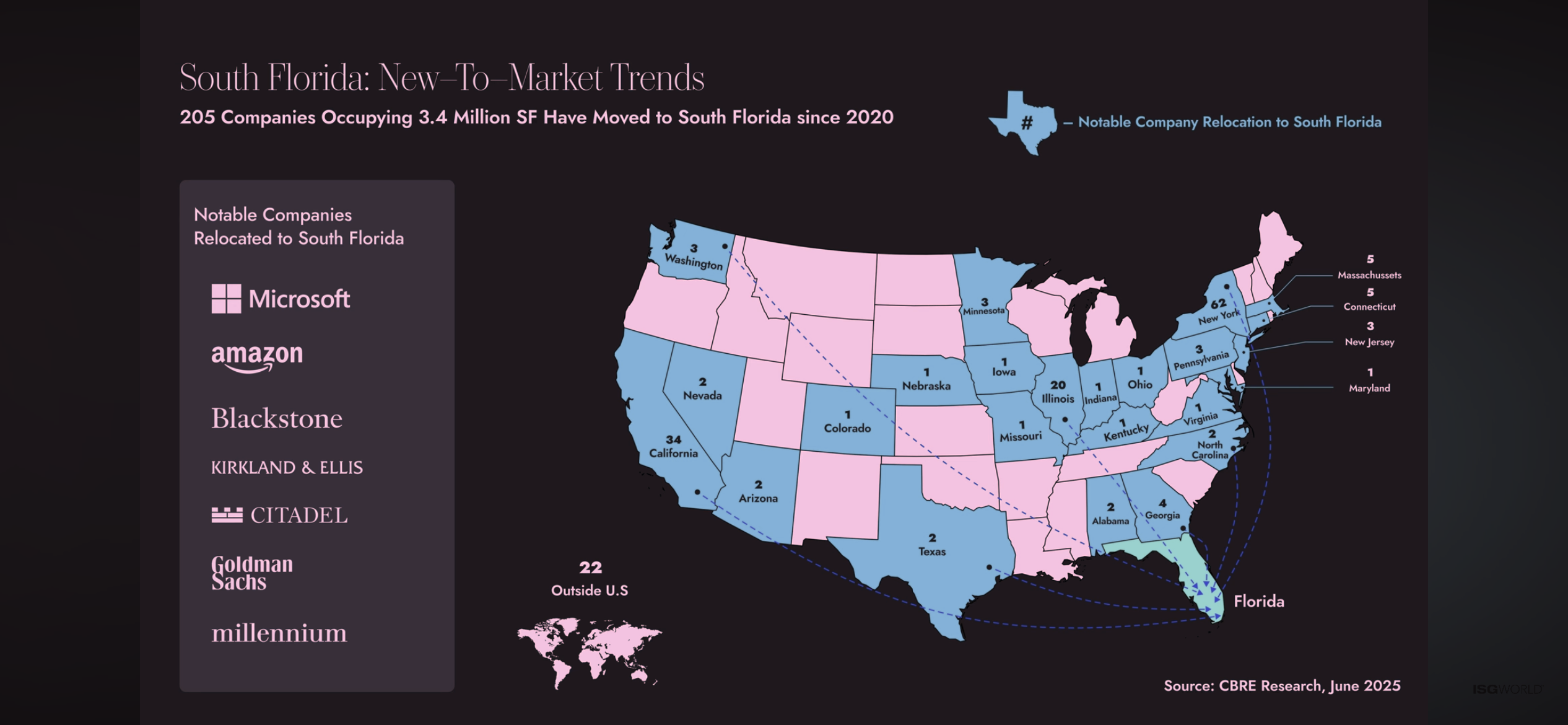

Corporate Relocation and a Changing Resident Profile

According to CBRE, since 2020:

-

34 major companies relocated from California

-

62 companies relocated from New York

-

20 companies relocated from Illinois

This corporate migration is reshaping South Florida’s demographic profile toward:

-

Higher-income households

-

International professionals

-

Entrepreneurs and executives

These new residents tend to favor newer buildings, strong urban cores, and predictable operating costs, further concentrating demand in modern, well-capitalized developments.

Global Visibility and Structural Demand Multipliers

South Florida’s position as a global hub is reinforced by recurring, high-impact international events and connectivity, including:

-

Formula 1 Miami Grand Prix

-

Miami Open

-

FIFA World Cup 2026

-

Art Basel Miami Beach

-

Miami International Boat Show

-

One of the world’s largest cruise hubs

These events act as global marketing platforms, repeatedly converting visitors into second-home buyers, investors, and long-term residents.

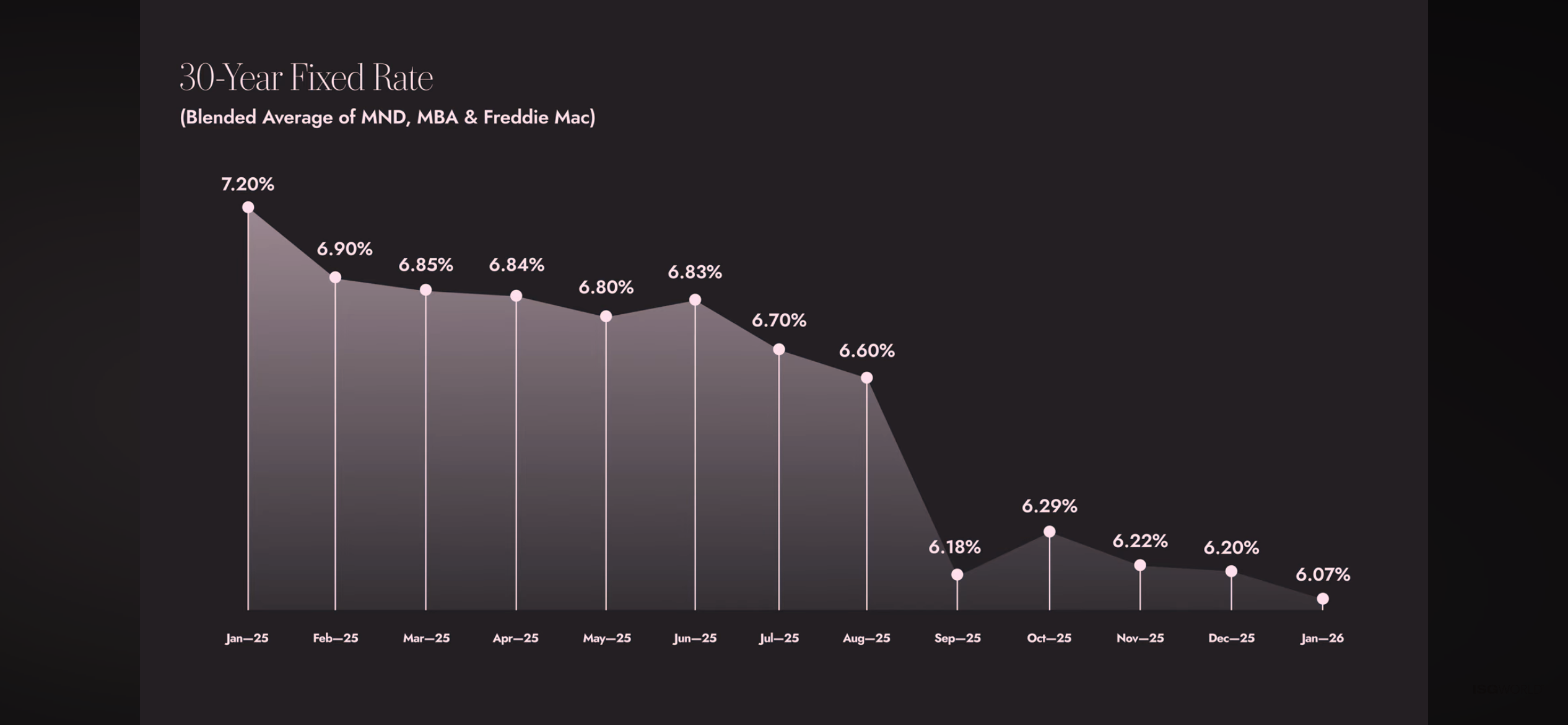

Why 2026 Looks Stronger—But Still Selective

The 2025 data confirms that South Florida is not experiencing a temporary boom, but a long-term structural transformation.

The convergence of:

-

Gradually declining interest rates

-

Sustained population growth

-

Continued corporate and capital migration

-

A limited supply of high-quality, modern inventory

-

Long delivery timelines for new high-rise developments

creates conditions supportive of continued strength in 2026, particularly in newer condominiums and prime single-family assets.

This does not imply uniform appreciation. It implies that selection matters more than ever.

Final Takeaway

South Florida does not suffer from excess housing supply. It suffers from a shortage of relevant, modern, deliverable inventory—and that shortage takes years, not months, to resolve.

That reality explains why the market held under pressure in 2025, and why fundamentals—not speculation—continue to support the outlook ahead.

Source & Attribution

This article is an independent analytical summary based on publicly available market data, including Realtor Association statistics and insights from the Miami Report™ Q4-2025 Update, presented by Craig Studnicky, CEO of ISG World, featuring special guest Ana Bozovic. All interpretations and conclusions are original and provided for informational purposes only.

All Copyrights Reserved Monika Texier 2026